Summary of markets last week:

This past week has been eventful in markets with various quarterly earnings updates by major companies, several releases of macro data, and some key Fed commentary. All of which has generated mixed messages about the US growth and inflation outlook (and, with that, large daily price swings in US equities). In particular, equities sold off sharply ahead of Wednesday’s Fed press conference. They then rallied later in the week, most notably on Friday’s nonfarm payrolls. Elsewhere rates and bond yields fell post Fed meeting and then again on Friday, while the dollar was also lower.

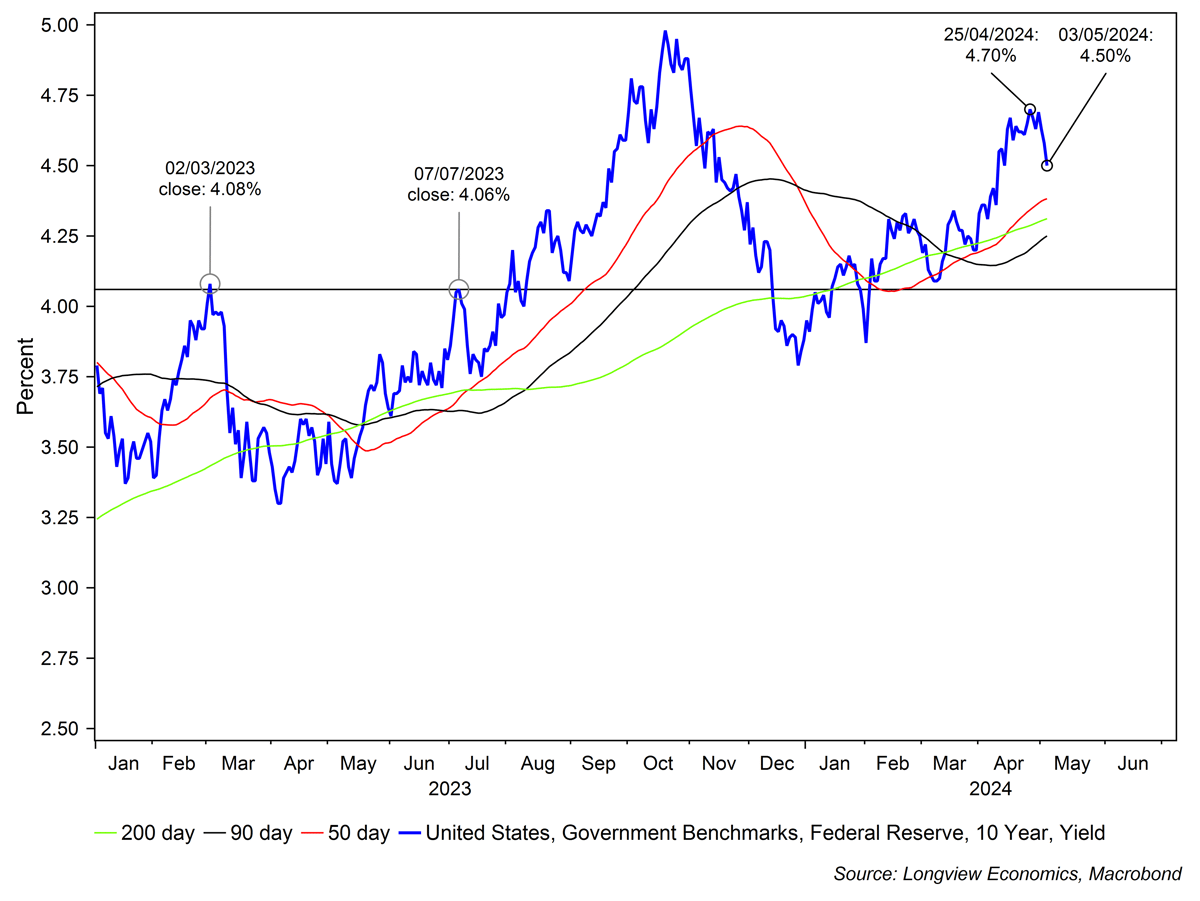

With US equities therefore struggling to find direction this past week, the key question has become: Is this pullback ongoing? Or are equities starting to stabilise, with the uptrend about to resume? The move lower in rates/bond yields, in that respect, is encouraging for the bulls (e.g. see 10 year yields in the chart below, which are down ~20bps from their 25th April high). Equally, as we’ve noted in recent research, a number of positioning, liquidity, and macro factors create a potentially challenging set up for equities in the next few months.

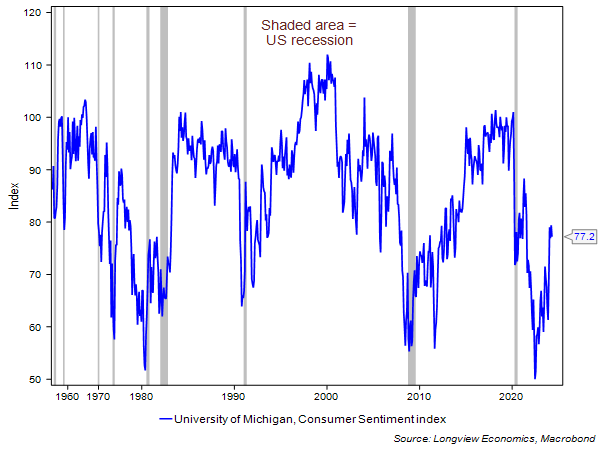

Key macro data and events this coming week, as well as certain speeches by Fed presidents, all bear watching closely in that respect. In particular, US data includes the SLOOS credit conditions survey (Monday); consumer credit (Tuesday); and the Michigan sentiment survey (Friday). There are also speeches by several key Fed Presidents this week, including Barkin, Williams, and Goolsbee, among others, while several key companies are due to report their earnings. Please see below for a full list of key macro data, earnings, and events for the week ahead.

Key chart: US 10-year Treasury yield (%), shown with 50, 90, & 200 day moving averages

The most important macro data, events & earnings reports out next week

|

Events: |

Fed policy decision (Wed, 7pm) followed by Powell press conference (7:30pm). |

|

Monday: |

German headline CPI (April first estimate, 1pm). |

|

Tuesday: |

Chinese manufacturing (NBS & Caixin) & service (NBS) sector PMIs (Apr, NBS at 2:30am & Caixin at 2:45am); Eurozone Q1 GDP (first estimate, 10am). |

|

Wednesday: |

US ADP employment change (Apr, 1:15pm); US JOLTS job openings (Mar, 3pm); US ISM manufacturing (Apr, 3pm). |

|

Thursday: |

US Challenger job cuts (Apr, 12:30pm). |

|

Friday: |

US nonfarm payrolls, hourly earnings & unemployment rate (Apr, 1:30pm); US ISM services (Apr, 3pm). |

|

Key earnings: |

Amazon, Eli Lilly, Coca-Cola, AMD (Tues); Mastercard, Qualcomm (Wed); Apple, Shell (Thurs). |

Key Longview research published last week

You'll find some extracts from research we've published recently below. The full reports are available to subscribers. To see the options we have available for private investors, please click below.

Tactical Equity Asset Allocation No. 244, 2nd May 2024:

"Equities: Further Near Term Downside Expected"

On 23rd April, we moved ‘Tactically’ NEUTRAL equities (having been overweight since October 2023). In that publication we outlined the five different types of pullbacks in bull markets, and argued that this current one is most likely to be either: i) a “healthy 5 – 10% correction”; or ii) a “correction driven by a mid-cycle slowdown”. As such, we advised “near term caution” and removed our OW equities position.

Since that time, US equities are broadly unchanged with the S&P500 having rallied up to its 50 day moving average (at 5,160) before pulling back (over the past two days – fig 1). Our views from April 23rd remain unchanged. In particular, there are 4 reasons why we expect continued further downside in US (& global) equity markets over coming weeks (potentially months).

Commodity Fundamentals Report No. 182, 1st May 2024:

"Oil: How Much Downside?"

“Oil market price action has, broadly speaking, followed the classic ‘buy the rumour, SELL the fact’ pattern in recent weeks...

…By the time of Israel’s bombing of the Iranian embassy in Syria (1st April), though, most of the move was done. That is, prices then edged up a little further (in anticipation of an escalation) but, by April 5th, the news was in the price (i.e. there was no/little price upside beyond that date”

Source: Longview on Friday: “Bonds, Equities & Oil – Latest Thoughts”

Markets are forward-looking discounting machines. It’s somewhat unsurprising, therefore, that the oil price topped on the news of conflict between Israel and Iran. In other words, oil prices rallied ahead of the event, which had been largely priced in ahead of time (see quote above & last week’s LV on Friday for detail). Since then, the geopolitical risk premium has started to unwind, and the oil price is down almost 10% from its 12th April highs (helped by general risk aversion in markets).

North America: Key events next week

|

Events: |

Speeches by the Fed’s Barkin on the economic outlook (Mon, 5:50pm), Williams in Fireside chat (Mon, 6pm), Kashkari in Fireside Chat (Tues, 4:30pm), Jefferson on careers in economics (Wed, 4pm), Collins to MIT students (Wed, 4:45pm), Cook on financial stability (Wed, 6:30pm), Bowman on financial stability risks (Fri, 2pm), Goolsbee in moderated Q&A (Fri, 5:45pm) & Barr gives commencement speech (Fri, 6:30pm); Bank of Canada releases financial system review (Thurs, 3pm). |

|

Monday: |

US Senior Loan Officer Opinion survey (7pm). |

|

Tuesday: |

US consumer credit (Mar, 8pm). |

|

Wednesday: |

US wholesale inventories (March final estimate, 3pm). |

|

Thursday: |

N/A |

|

Friday: |

Canadian employment data (change in employment, unemployment rate & participation rate, Apr, 1:30pm); US Michigan sentiment (May first estimate, 3pm); US monthly budget statement (Apr, 7pm). |

|

Key earnings: |

Berkshire Hathaway, Vertex, Simon Property, Palantir, Microchip, Realty Income, The Williams Companies, Fidelity National Information Services (Mon); Disney, Arista Networks, Duke Energy, Transdigm, McKesson, Suncor Energy, Occidental Petroleum, Sempra, Datadog, Intact Financial, Kenvue, EA, Rockwell Automation (Tues); Uber, Shopify, Anheuser-Busch, Airbnb, Emerson, Manulife Financial, Energy Transfer, Nutrien, HubSpot (Wed); Constellation Energy, Sun Life Financial, Telus, Wheaton Precious Metals (Thurs); Enbridge, Constellation Software (Fri). |

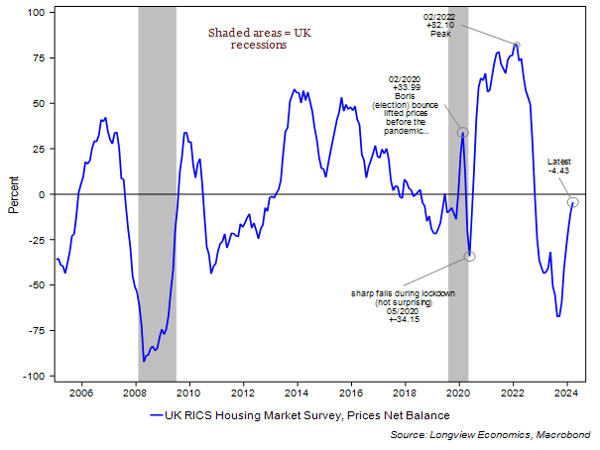

Fig B: US Michigan Sentiment (index)

Eurozone: Key events next week

|

Events: |

Speeches by the ECB’s Villeroy, Nagel & Panetta at BIS innovation summit (Mon, 12:15pm-12:30pm), De Cos at BIS summit (Tues, 2pm), Wunsch in Frankfurt (Wed, 1pm), Cipollone on ‘the tokenisation of financial instruments – prospects for the Italian market’ (Thurs, 1:15pm), Guindos in Madrid (Thurs, 1:15pm) & Cipollone on the digital euro (Fri, 8am); ECB publishes account of April policy meeting (Fri, 12:30pm); ISTAT releases note on the Italian economy (Fri, 10am). |

|

Monday: |

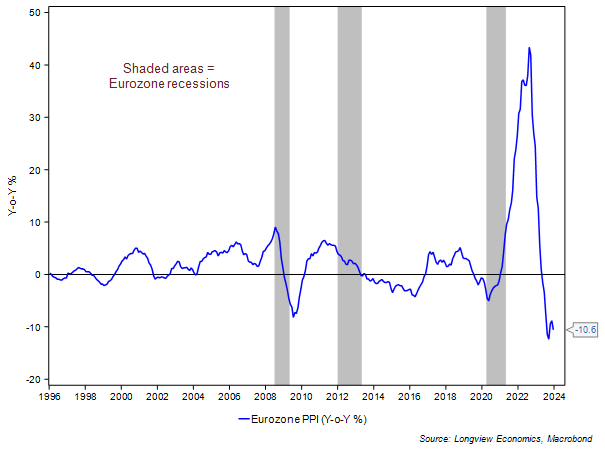

HCOB service sector PMIs for Italy (8:45am), France (8:50am), Germany (8:55am) & Eurozone (10am) – all April final estimates apart from Italy; Eurozone Sentix investor confidence (May, 9:30am); Eurozone PPI (Mar, 10am). |

|

Tuesday: |

German factory orders (Mar, 7am); German imports & exports (Mar, 7am); French wages (Q1 first estimate, 7:45am); Eurozone retail sales (Mar, 10am). |

|

Wednesday: |

German industrial production (Mar, 7am); Italian retail sales (Mar, 9am). |

|

Thursday: |

N/A |

|

Friday: |

Italian industrial production (Mar, 9am); Italian industrial sales (Feb, 11am). |

|

Key earnings: |

UBS, Ferrari, UniCredit, Siemens, Deutsche Post, Infineon (Tues); BMW, Munich Re, Henkel (Wed); Enel (Thurs). |

Fig C: Eurozone PPI (Y-o-Y %)

UK: Key events next week

|

|

|

|

|