Recommendation (1 – 2 week Equity Index Trading Recommendation):

Stay ¼ LONG December S&P500 futures;

Retain stop at 2% below entry (i.e. at 3,561).

Rationale

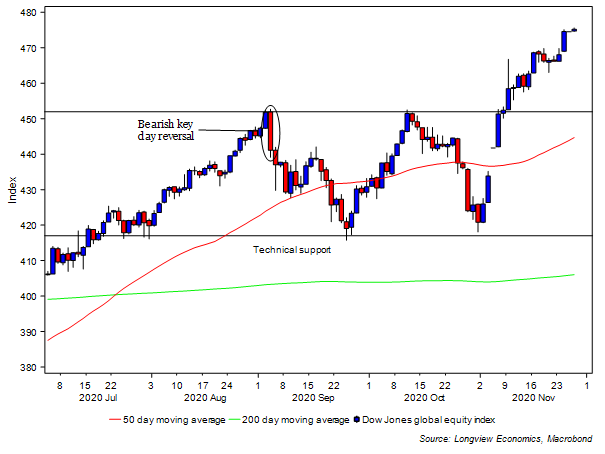

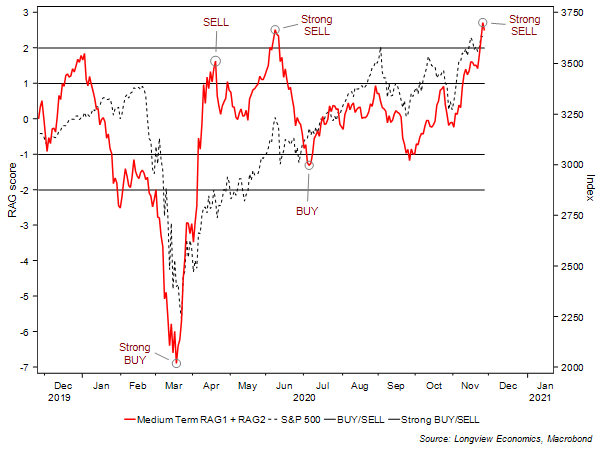

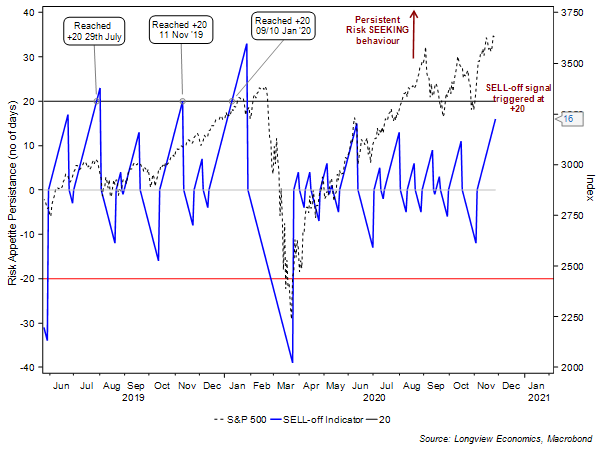

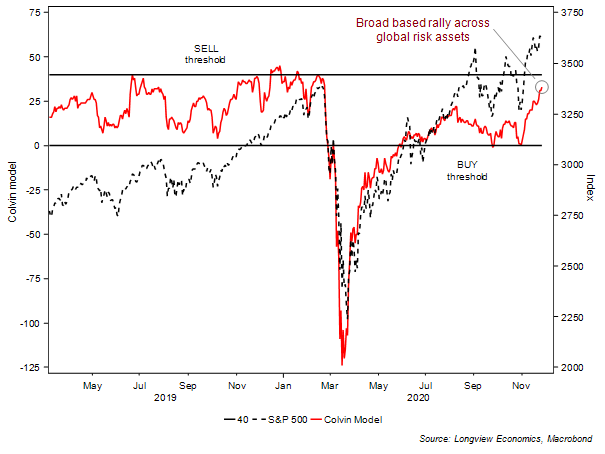

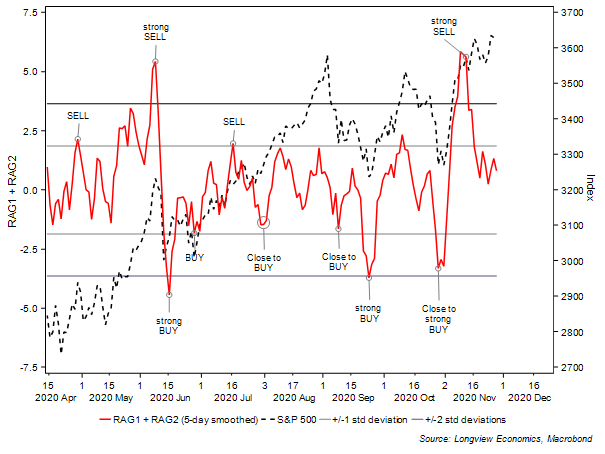

While US markets were closed yesterday, global equities continued to edge up (see FIG 1), having trended persistently higher this month (+13% MTD). With that, signs of medium term exuberance have continued to build in markets. That’s the message of a number of our models: (i) Our combined medium term ‘RAG1 plus RAG2’ model has recently turned strong SELL (FIG 2); (ii) the Colvin model, which measures breadth across global asset prices, is close to SELL (FIG 2b); & (iii) our SELL-off indicator continues to build towards its +20 level (at which it warns of a heightened risk of a wave of risk aversion, see FIG 2a). Downside risks to markets are therefore rising (in the medium term).

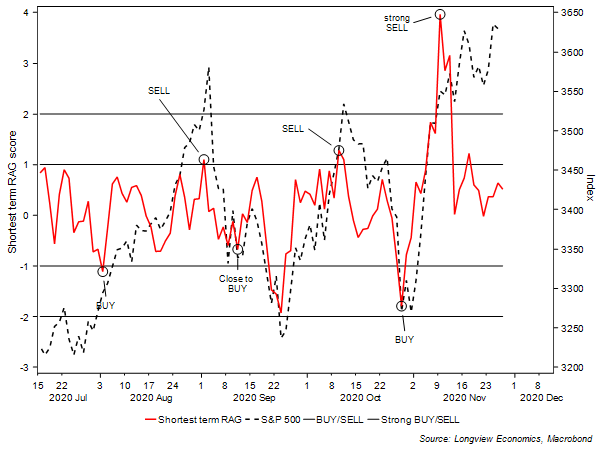

During phases of rising exuberance, though, and whilst our SELL-off indicator builds towards its key level, it pays to stay with upward momentum (and opportunistically run LONG positions). That’s especially the case when our short term models are not carrying a clear SELL message. In that respect, many of those short term models are currently NEUTRAL. In particular, and most importantly, ‘shortest term RAG’ is mid-range (FIG 3). In environments of rising exuberance, it pays to watch this model closely as it’s most useful for, and principally designed for, timing market direction in the very near term (i.e. over 1 – 3 trading days). Of interest, other risk appetite models are also broadly NEUTRAL at this juncture (e.g. see combined RAG1 plus RAG2, FIG 3a, as well as our fund flow model).

As such, and while signs of complacency and exuberance continue to grow, the risk reward favours staying opportunistically with upward momentum in equities (see above for detailed recommendation).

Key risks, as always, are multiple and include signs that cracks in financial markets are emerging (most notably with a sharp move lower in Bitcoin yesterday, and further weakness overnight). Other risks include ongoing challenges in Europe with respect to agreeing the next budget/stimulus package (see HERE for detail). Volumes are also expected to remain light today (with a half day of US trading following Thanksgiving yesterday). It’s also worth emphasising that this is an opportunistic short term 1 – 3 day trade. The next significant move in markets is likely to be some marked weakness, once key medium term indicators are generating across the board SELL signals.

Kind regards,

Longview Economics/Shortview Trading

FIG 1: DJ global equity index shown with 200 & 50 day moving averages

Medium term models – on/close to SELL…

FIG 2: Medium term RAG1 & RAG2 vs. S&P500

FIG 2a: Longview SELL-off indicator (vs. S&P500)

FIG 2b: Longview Colvin model vs. S&P500

Short term risk appetite models – broadly NEUTRAL

FIG 3: Longview Shortest term RAG model vs. S&P500

FIG 3a: Longview combined key ‘risk appetite’ models (RAG1 + RAG2) vs. S&P500

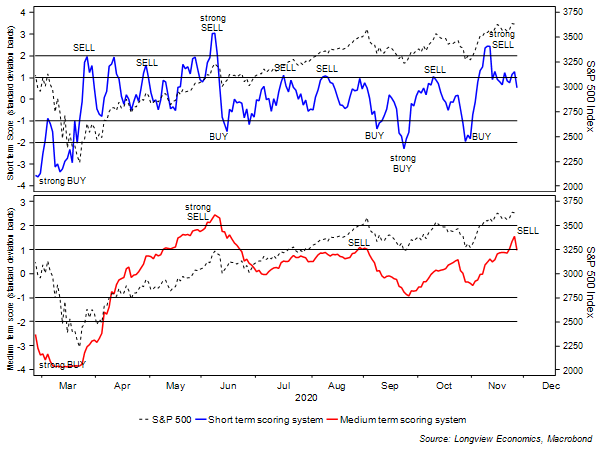

Key Longview Scoring Systems (chart below):

Short term (1 – 2 week) scoring system (fig 1b): NEUTRAL (from SELL yesterday)

Medium term (1 – 3 month) scoring system (fig 1c): NEUTRAL (from SELL yesterday)

FIG A: Longview short and medium term scoring systems vs. S&P500

Key macro data/events

Key macro data today includes: Italian consumer confidence index (Nov, 9am); EZ consumer confidence (final Nov estimate, 10am).

Key events include: Day after Thanksgiving – US markets close at 1pm EST/6pm London time; Black Friday shopping day.

Definitions & other matters:

RAG = Risk Appetite Gauge

The ‘Daily RAG’ publication is designed to generate 1 to 2 week trading recommendations on equity indices. For trading recommendations on currencies, rates, bonds and other assets, pls see Macro-TAA trade publications.

For a Medium term recommendation please see our 1 – 4 month tactical market views which are updated at the start of each month in our Tactical Equity Asset Allocation publication (as well as occasional ad-hoc intra month Alerts). The latest update was published 10th November. If you are not on the distribution list and would like to receive these reports pls email info@longvieweconomics.com