At Longview, a lot of our time is spent performing in-depth analysis and number crunching to identify key details that matter most to our clients. Often, a lot of our analysis does not end up in our final publications. Earlier this week we published the Eurozone section of our Quarterly Global Asset Allocation No. 50, where we presented our outlook on recessionary fears surrounding the Eurozone economy. One of the key themes discussed was the potential fiscal easing in Europe. This blog piece aims to provide a sense of the detailed analysis we usually perform to draw conclusions and present our findings in simple terms. In this case, that being: there’s potentially 5% of GDP of fiscal easing in the pipeline in Europe over the next 18 months.

Overview

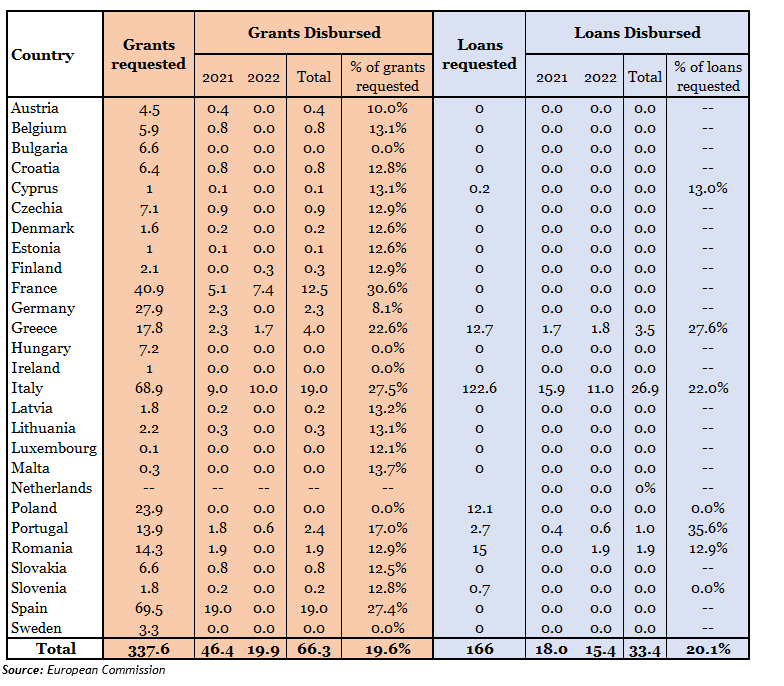

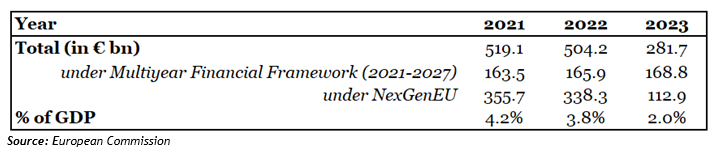

In response to the pandemic, the EU announced a multi-year ‘NextGenerationEU’ stimulus plan in 2020. When announced, the plan combined with the usual 7-year Multiannual Financial Framework equated to fiscal easing of 4.2% of GDP in 2021, 3.8% this year, and 2.0% next year (table 1). The spending under NextGenerationEU, under various programmes (fig 1), aims to modernise health, agriculture, research and innovation, enable digital transition, promote biodiversity and gender equality & fight climate change.

Table 1: European Commission fiscal spending incl. ‘NextGenerationEU’ (in €bn, current prices)

Fig 1: NextGenerationEU fund breakdown by programme (in €bn, current prices)

Financing

To finance an additional stimulus plan as large as the NextGenerationEU, the European Commission will borrow on the markets at more favourable rates than many Member States and redistribute the amounts. To raise up to around €800 billion in current prices until 2026 for NextGenerationEU under the best financial terms – 5% of EU GDP – the Commission will use a diversified funding strategy. The Commission’s diversified funding strategy combines:

- An annual borrowing decision; Funding plan key parameters communicated biannually, to offer transparency and predictability to investors and other stakeholders;

- Structured and transparent relationships with banks supporting the issuance programme (via a Primary Dealer Network);

- Multiple funding instruments (medium and long-term bonds, some of which will be issued as NextGenerationEU green bonds, and EU-Bills) to maintain flexibility in terms of market access and to manage liquidity needs and the maturity profile;

- A combination of auctions and syndications, to ensure cost efficient access to the necessary funding on advantageous terms.

In addition, the Commission proposed three new sources of revenue in December 2021 to help repay the grants part of the NextGenerationEU:

- Emissions Trading system own resource;

- Carbon border adjustment mechanism own resource;

- Own resource based on the reallocated profits of very large multinational companies.

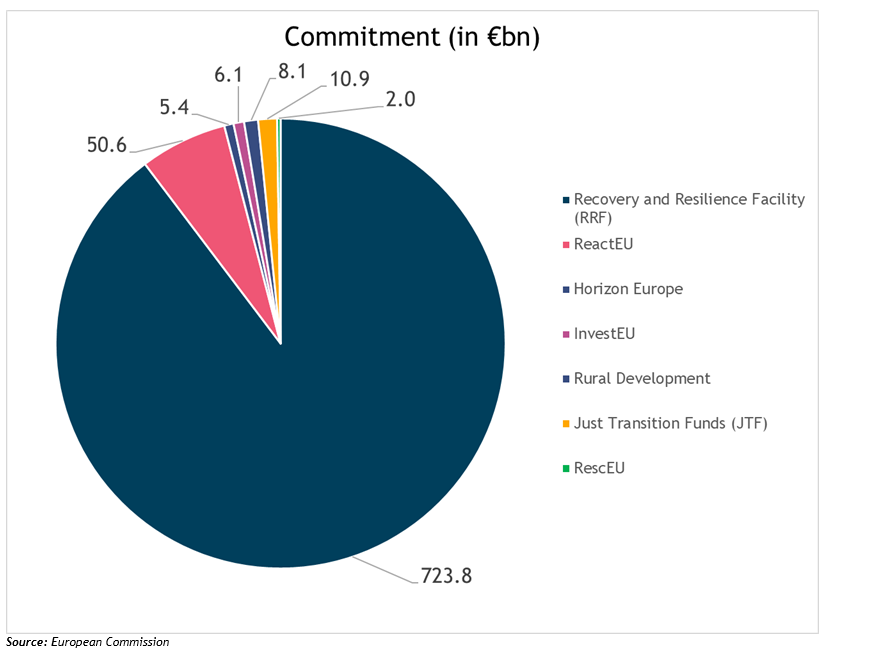

Member states proposals: assessment and approval

Most of the fund commitment (i.e. 90%), as announced in 2020 is in the form of grants (€338bn) and cheap loans (€386bn) under the Recovery and Resilience Facility (RRF, see table 2), a temporary instrument. The centrepiece of NextGenerationEU, RRF funds aim to make European economies and societies more sustainable, resilient and better prepared for the challenges and opportunities of the green and digital transitions.

Table 2: Recovery and Resilience Fund, commitments made by the EU (in €bn, current prices)

All member states had to submit their national plans, requesting a mix of preferred grants and loans along with milestones and targets outlined in detail under the 6 policy pillars (fig 2). These plans were then assessed by the European Commission, who then endorsed the plan after evaluation and feedback. The European Council then approved the national plans, followed by the EU paying up to 13% of the total support upfront to kick-start the national recovery. However, Netherlands to date has not submitted a national recovery and resilience plan. Meanwhile, the national plans of Hungary and Poland were held up on concerns about the governments’ ability to guarantee proper spending of EU money, because of their politicised courts. It was only in June 2022, when the EC endorsed Poland’s plan while no progress has been made re. Hungary’s plan.

Fig 2: Six pillars of Recovery and Resilience Fund

Disbursement

After the pre-financing payment is made, member states must implement the reforms and investments. Upon completion of those agreed milestones and targets, member states can request disbursements up to twice a year. The commission then expects to assess the request within two months of the submission, after which the funds are disbursed again.

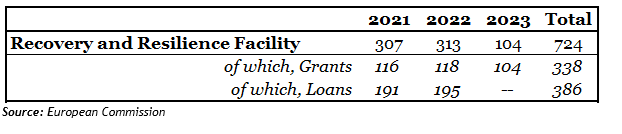

Some of those grants and loans have been paid out to member states (table 3). However, the complicated structure has meant that the actual disbursement of funds has been remarkably slow, and lagging the yearly commitments outlined in the 2020 announcement. In particular:

- Grants: Member states have requested all of the €338bn. Of which, only €66bn has been paid out so far. Out of that €66bn, France, Italy and Spain have received €50bn.

- Loans: The take up for the loans has been slower. Of the €386bn worth of loans made available, only €166bn have been requested, and €33bn has been disbursed (of which, €27bn to Italy). Only 7 member states have requested loans so far, as it appears that most countries find it more favourable to borrow at market rates for the specific country.

Overall, only 20% of requested grants have been disbursed, and same is the case for loans. Moreover, only 5 countries (Portugal, Italy, Greece, France and Spain) have fulfilled their first set of milestones and targets, and received their 1st payment.

The path ahead

As outlined in our Eurozone extract, we believe that the pace of stimulus disbursal should pick up. €272bn worth of grants and €353bn in cheap loans is yet to be paid and can potentially be used to boost the European economy in the next 18 months. Overall, therefore, there’s potentially an additional €625bn in fiscal easing (i.e. €272 + €353bn) that could be paid out over the next 18 months (i.e. about 5% of GDP).

Table 3: Recovery and Resilience Fund funds requested and disbursed (country-wise breakdown, in €bn)